The term “bank run” is not heard often, especially in today’s society. A bank run is when a large number of customers of a bank (or other financial institutions) withdraw their deposits at the same time, due to fear about the bank’s ability to pay back its liabilities.

On March 10, SVB (Silicon Valley Bank) failed due to a bank run. So why did this happen, and how can it be prevented in the future?

Perhaps the most famous historical bank run is that of 1937, when the failing economy led investors to panic, causing them to withdraw their money. To understand why this is an issue, people first need to understand a very important fact: banks like to make a profit.

Most people see only the place where they withdraw money and make deposits, not knowing about the inner workings of the bank itself.

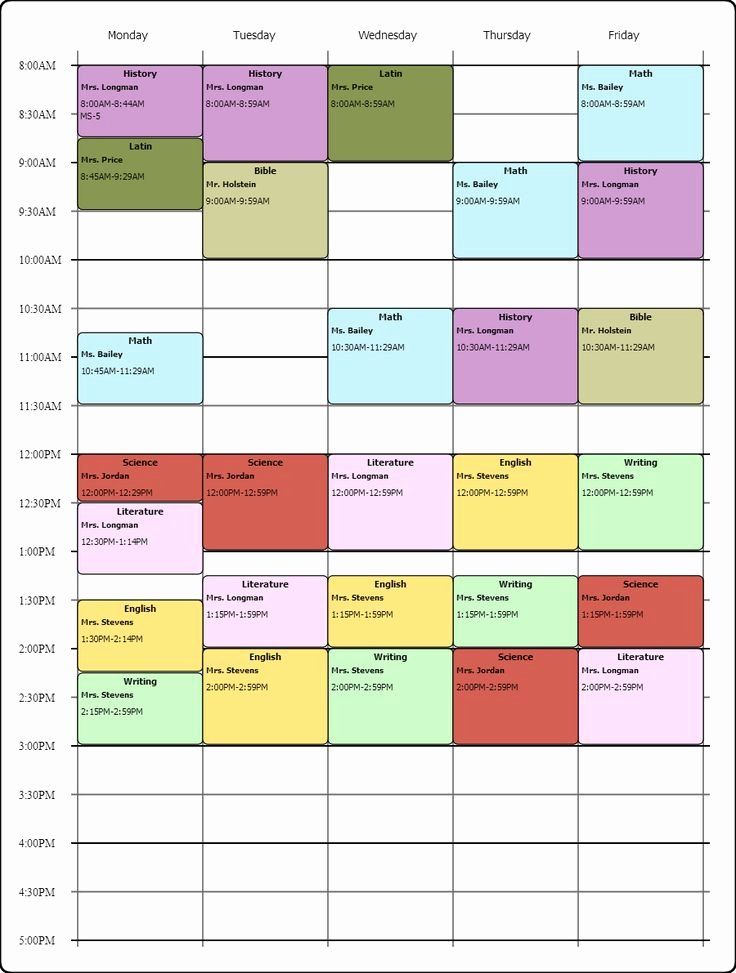

After some money is deposited in a bank, the bank will keep a portion of it (known as the required reserves), which the Federal Reserve requires banks to keep (after the bank run of 1937). They then loan out the rest with interest, so they can make a profit (often, banks may make risky investments with high-interest rates).

So in the 1937 bank run, banks did not have a required reserve ratio, and thus loaned out the majority of their money. When people began to withdraw massive amounts of money, the banks ran out of money and the banks collapsed.

Following this disaster, the Federal Reserve was formed, which created preventive measures against these bank runs. One of these was the reserve ratio.

The reserve ratio requires banks to hold a certain amount of money from each deposit so that they can give money to people trying to withdraw money.

According to Forbes’ “Silicon Valley Bank Collapse Suggests 0% Reserve Requirement Won’t Halt Bank Runs.”, in March of 2020, the Federal Reserve got rid of any reserve requirement, meaning that banks don’t have to hold any money in reserve. Later, the requirement was raised, but the banks had gotten used to what they were doing.

According to CNN Business’ “How Does a Bank Collapse in 48 Hours?”, after the Federal Reserve raised interest rates (to help stop inflation), technological companies (who are the main clients of SVB) stopped borrowing as much, because they have to pay back more.

After selling many of their securities (bonds they keep in deposit) for a loss, venture capital firms advised companies to withdraw their money, causing panic and thus a bank run.

The FDIC (Federal Insurance Deposit Company) has already taken over SVB and promised everyone that lost money their full money back. A happy ending, at least.